2025 Annual Survey: Industry Reports Increasing Expenses Impacting Revenue

Published on January 22, 2026Editor’s Note: Marina Dock Age’s annual marina survey was a joint effort in 2025 between the magazine, the Association of Marina Industries (AMI) and Storable Marine/Molo. The three entities had been developing their own surveys in previous years and decided that combining resources could raise response rates and bring more validity to the results. The survey was sent out via multiple channels in September, October and November. Results were presented during the 2025 Docks Expo and Marina Conference in Nashville, Tennessee, in December.

Respondent Profile

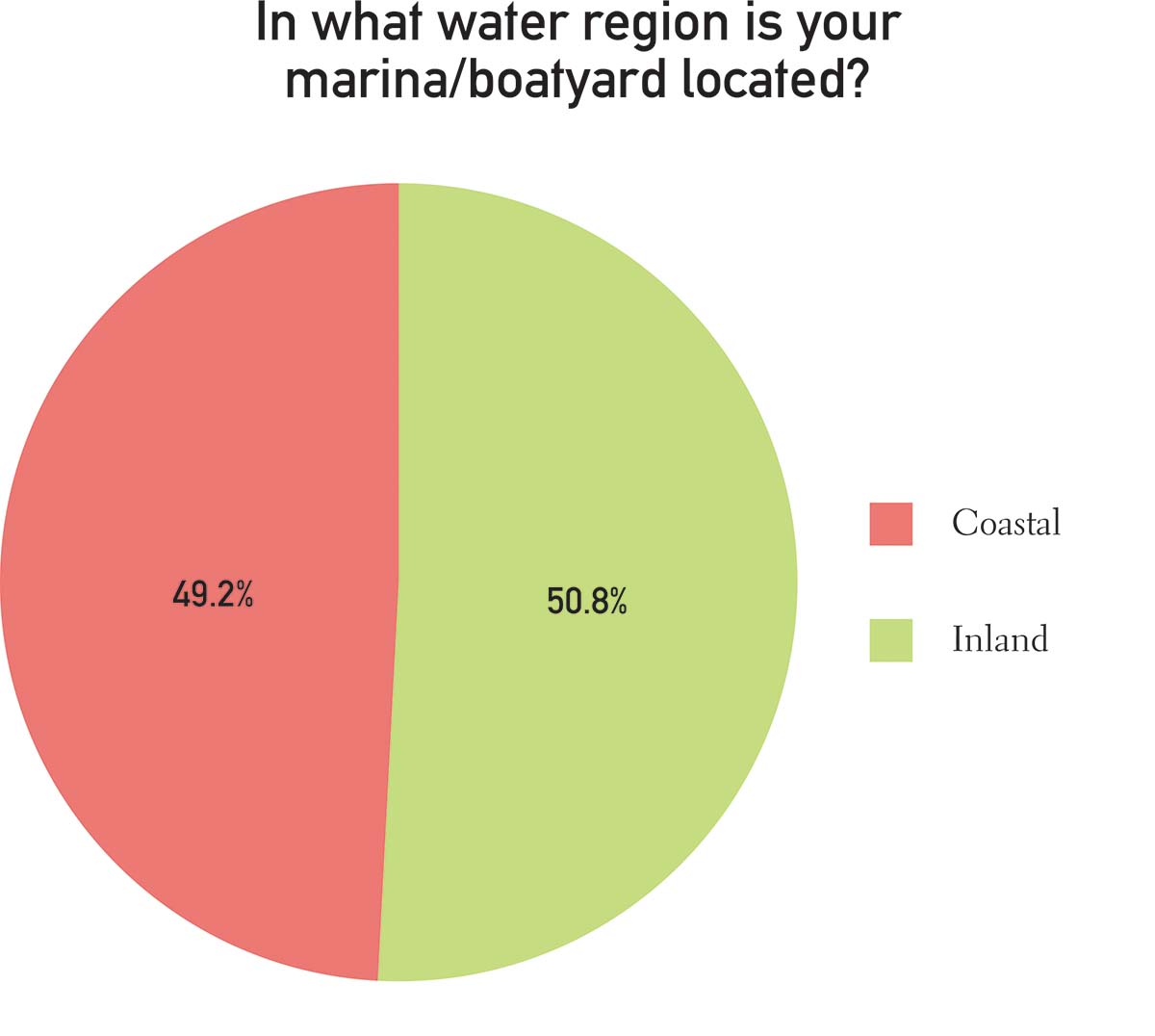

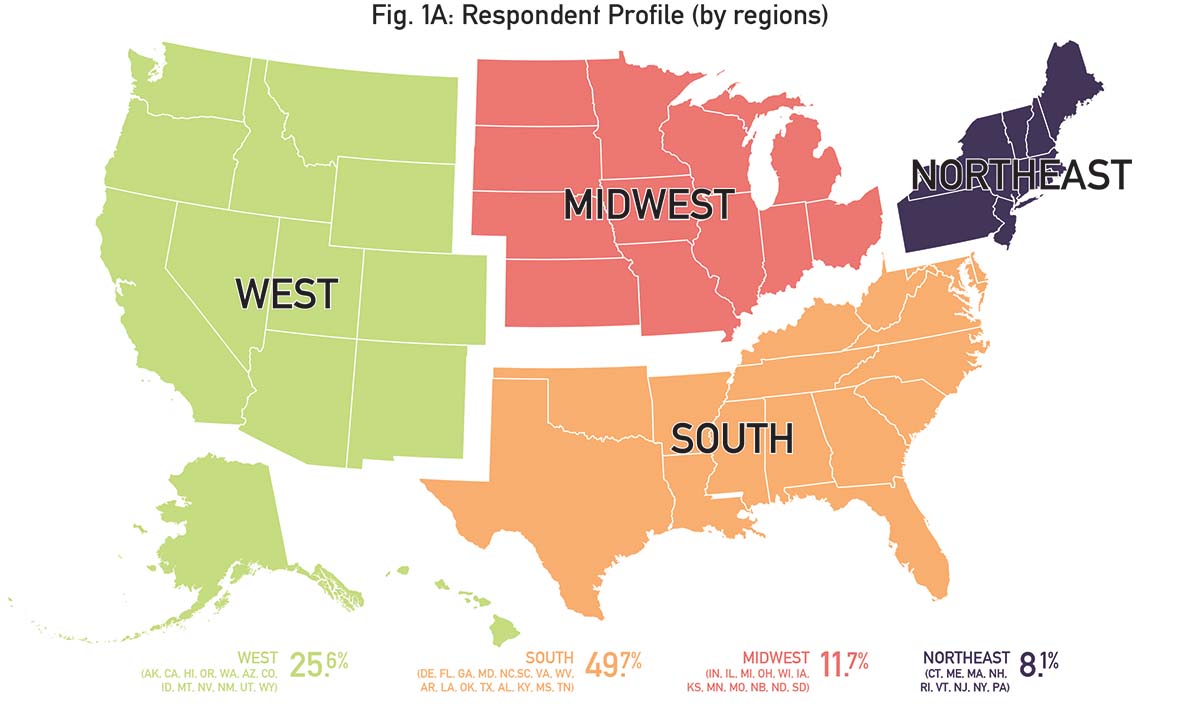

Responses were received from facilities across the country, with a nearly even split of coastal (49%) versus inland (50%) marinas. The highest number of respondents came from Texas, Florida, and Washington.

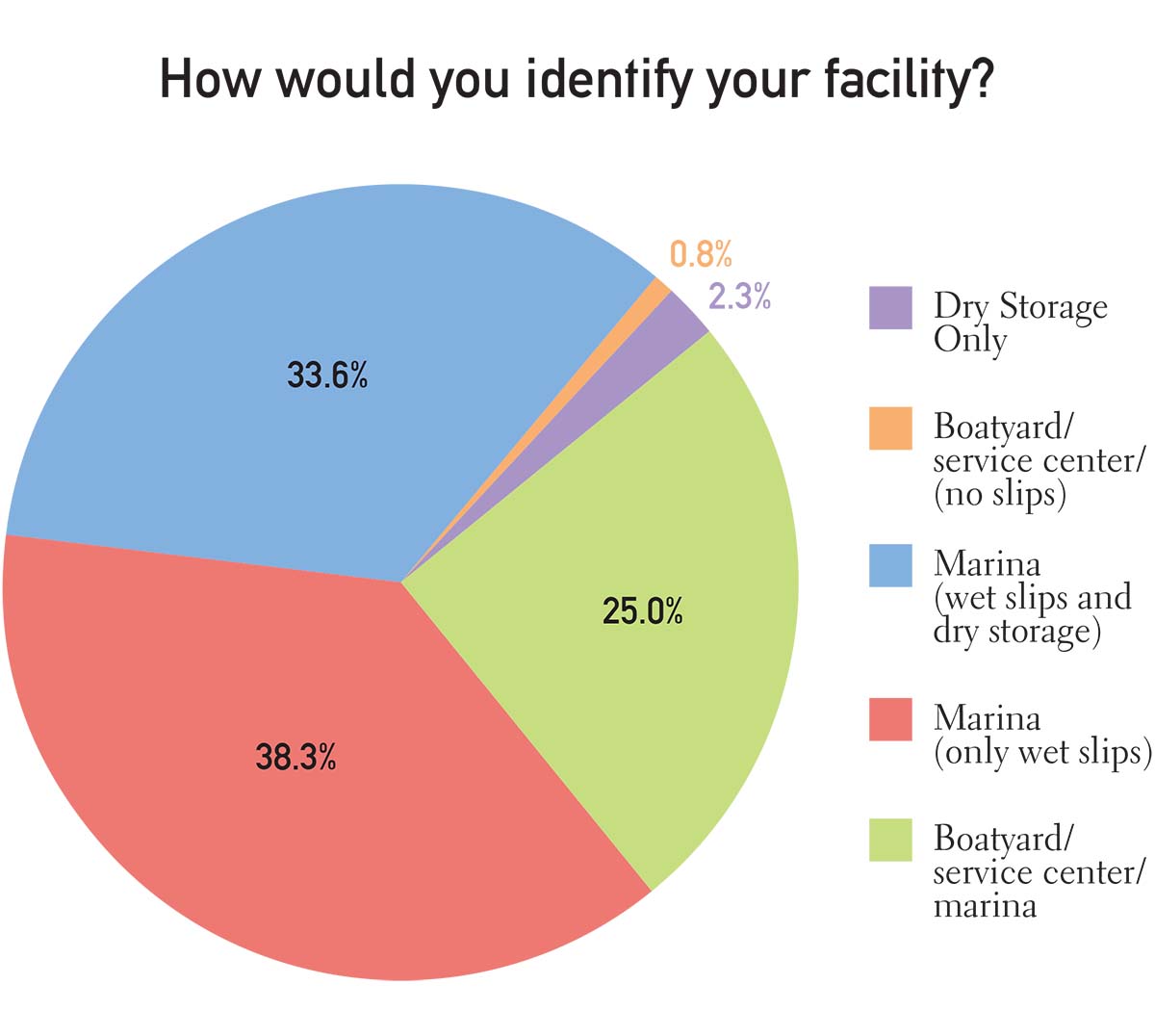

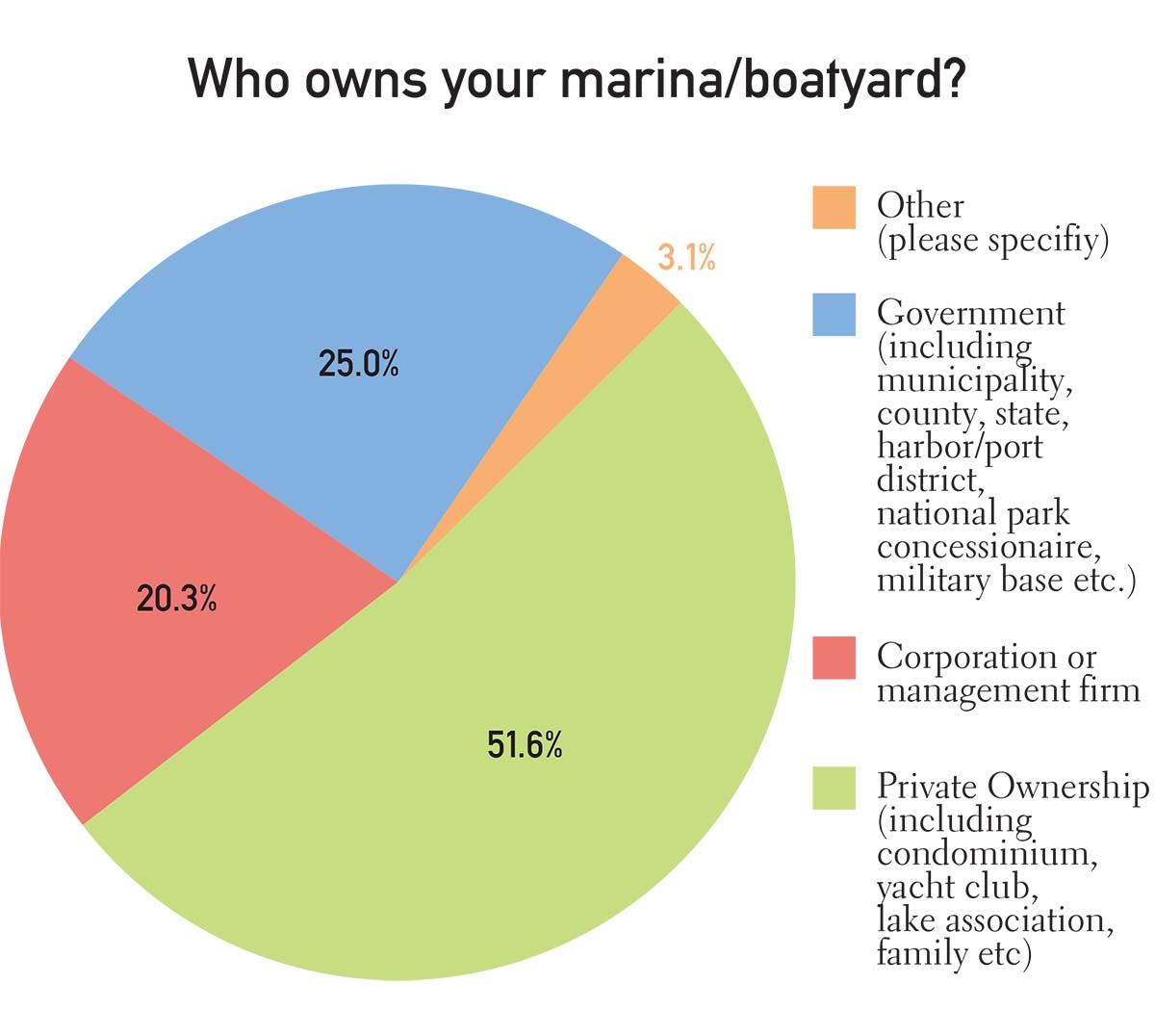

The marina businesses reflected a mix of wet slips only (39%), wet and dry storage (33%), and boatyard/service centers (25%). These facilities were mostly privately owned (51.56%), with other ownership being corporate or management firm (20.31%) or government (25%).

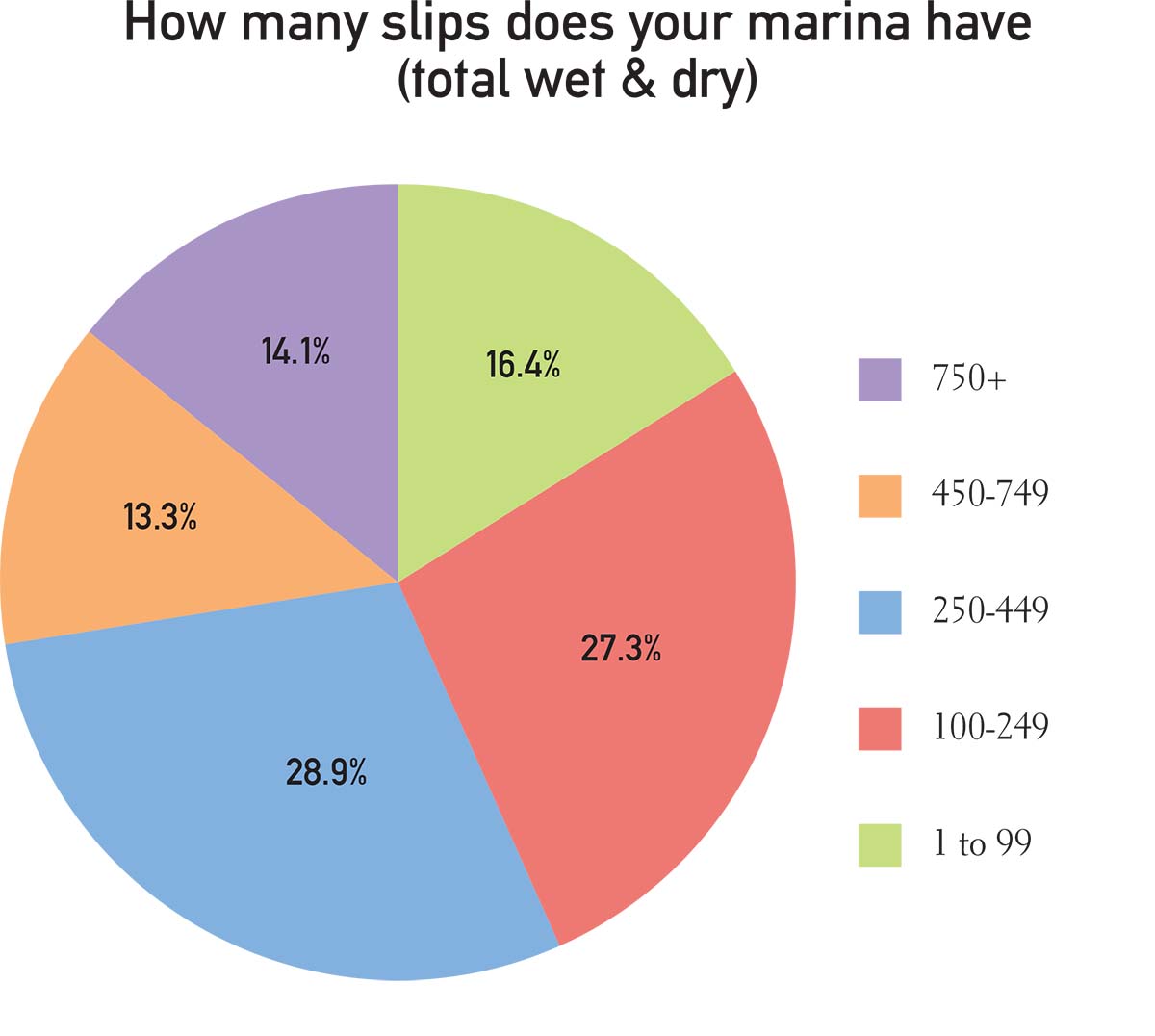

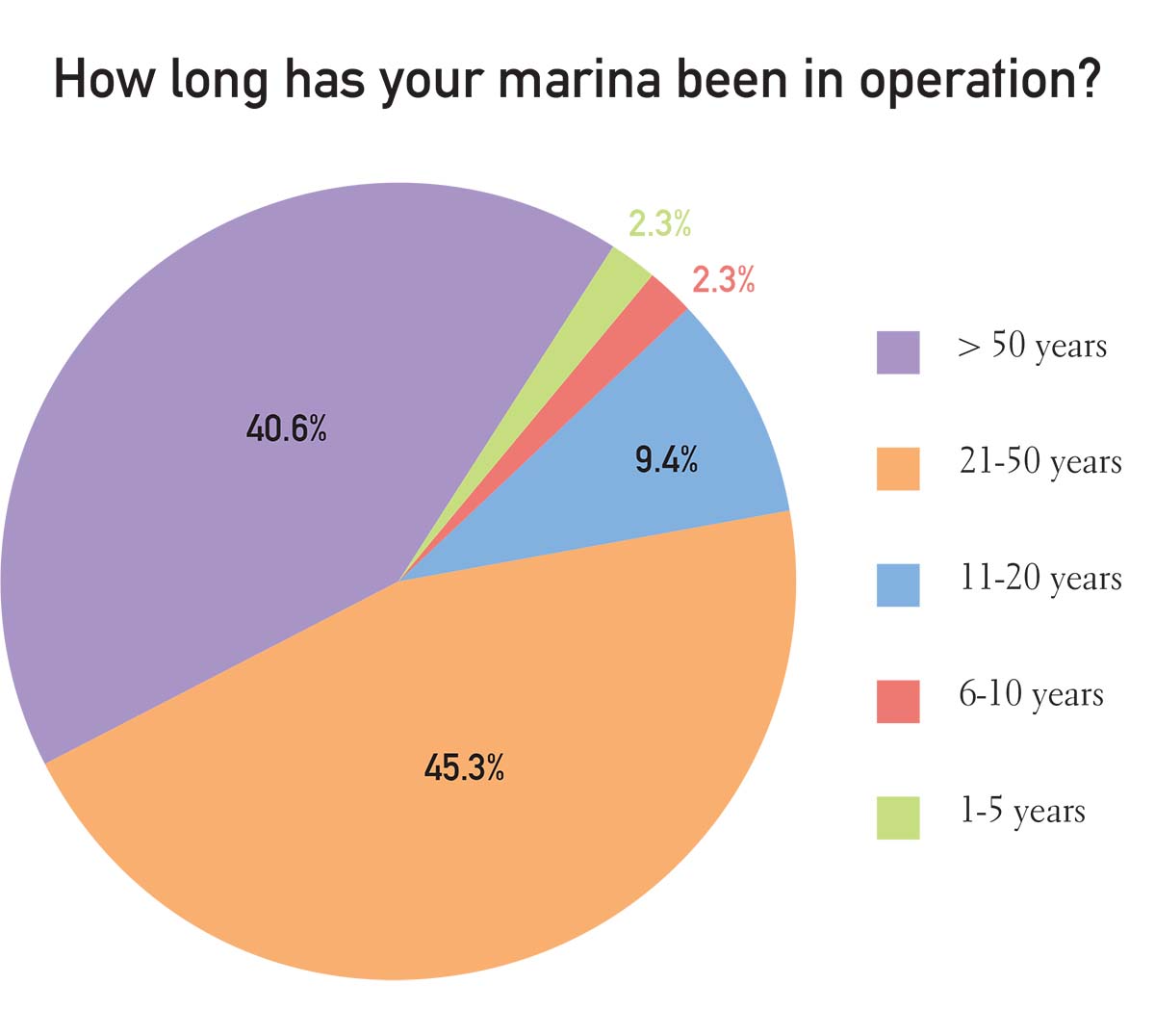

The majority of marinas had fewer than 500 slips (72.66%). Just 14.6% had more than 750 slips, and nearly 86% had been in operation for more than 20 years, including 40.63% that had been open for more than 50 years.

Occupancy Rates

A median occupancy rate of 92% indicated marinas continue to thrive despite a downward trend in boat sales. Confident in their consumers, 36% raised slip rates and 35% raised service rates.

Expenses and Profits

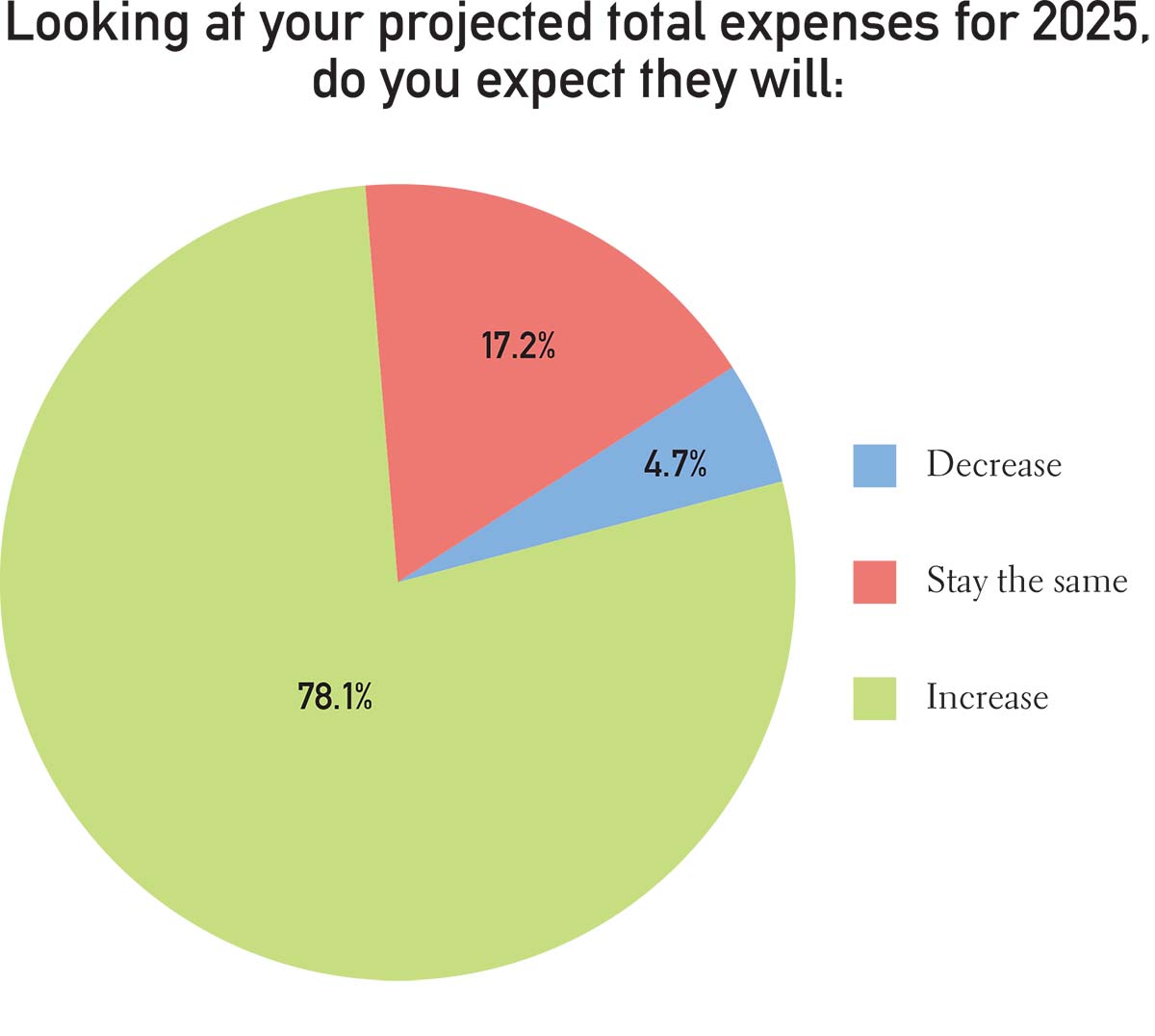

However, as a sign of an unstable economy, 78.13% expect expenses to increase, although just over half (52%) expect revenues also to increase.

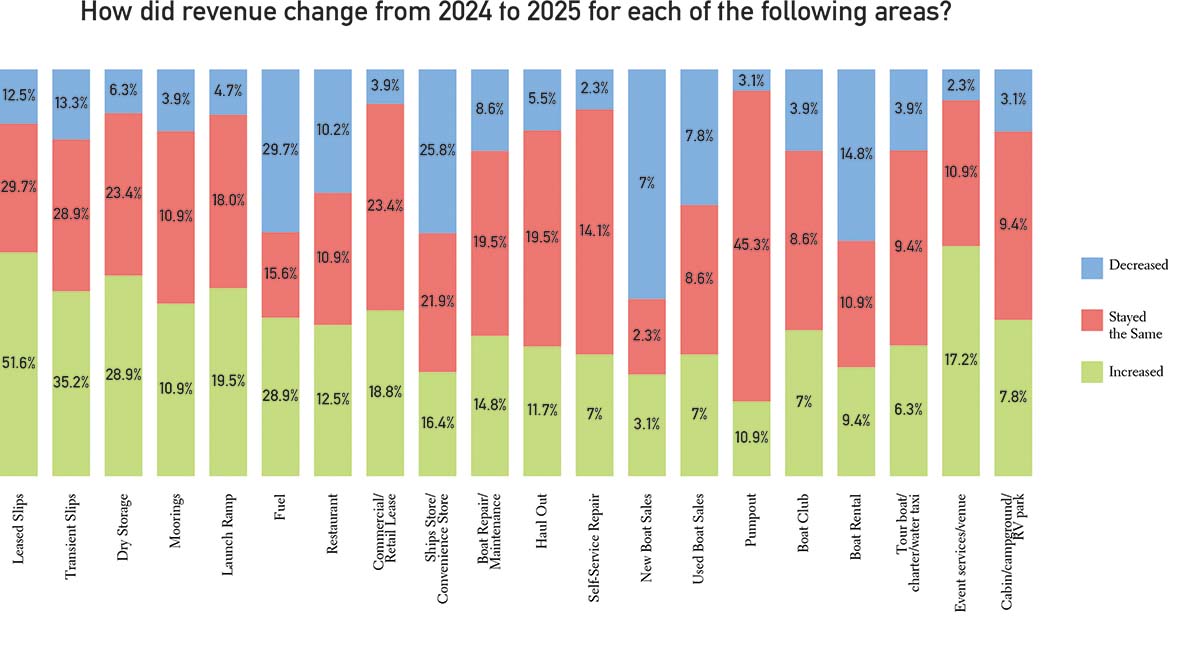

Revenues that increased the most were leased (51.56%) and transient slips (35.16%) and dry storage (28.91%). 28.91% of respondents also saw revenues increase for fuel sales.

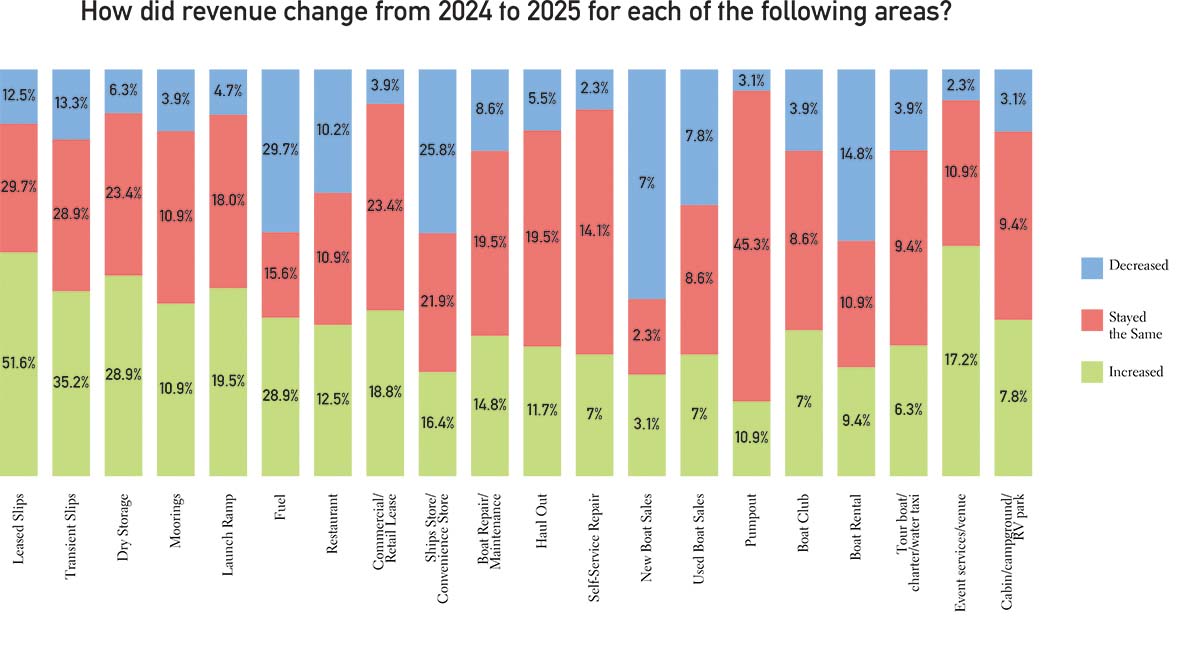

The No. 1 cause of stretched budgets was insurance, with 73.23% citing an increase in insurance expenses. Following closely behind were maintenance and renovation costs, with 69.29% citing a rise, and capital expenditure costs also rose for 58.73% of respondents. Other areas of increased expense were payroll (66.93%), benefits (51.97%), employee training (44.09%) and equipment (38.89%).

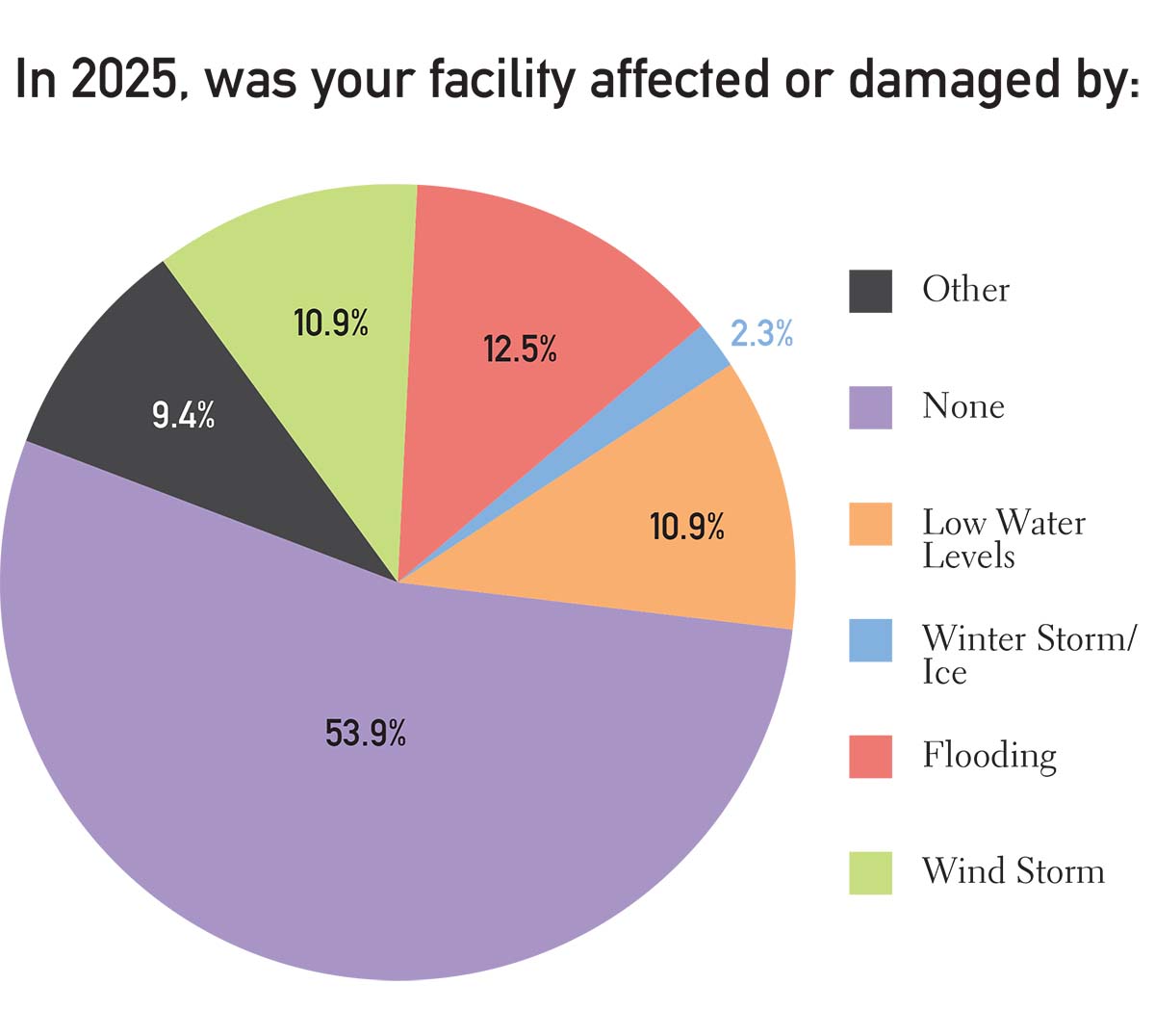

Natural Disasters

Overall, the marina industry fared well this past year when facing damage from natural disasters. Windstorms (10.94%), flooding (12.50%) and low water levels (10.94%) were the leading causes of damage; however, just over half of respondents (53.91%) faced no weather or climate challenges.

Infrastructure and Renovations

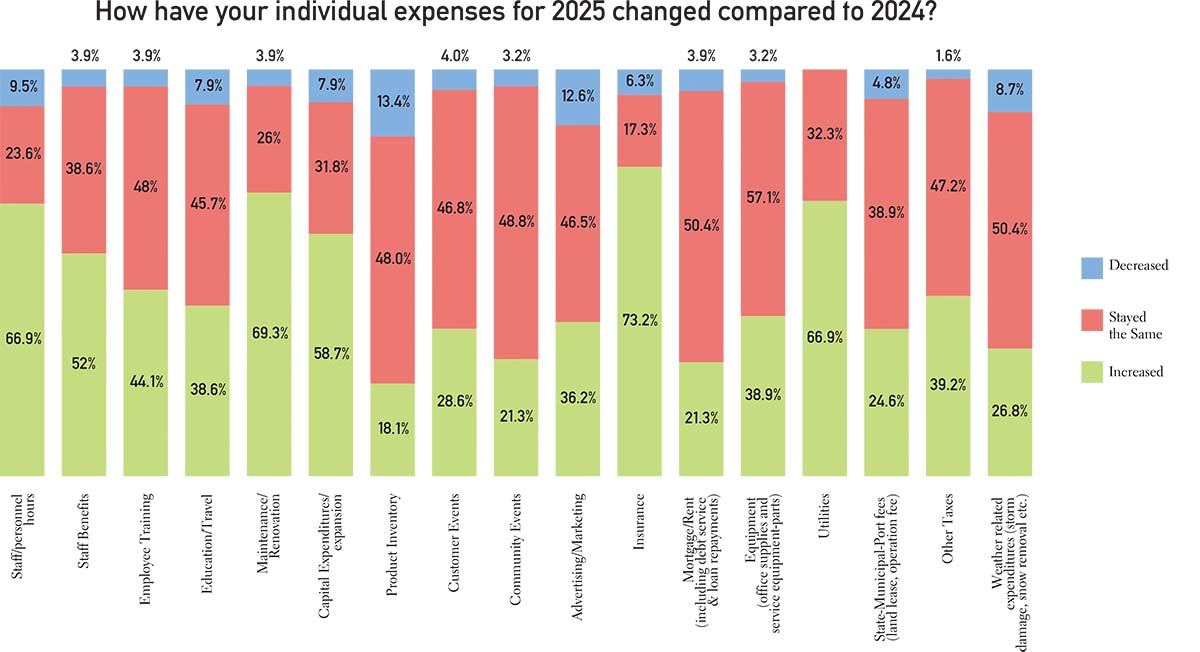

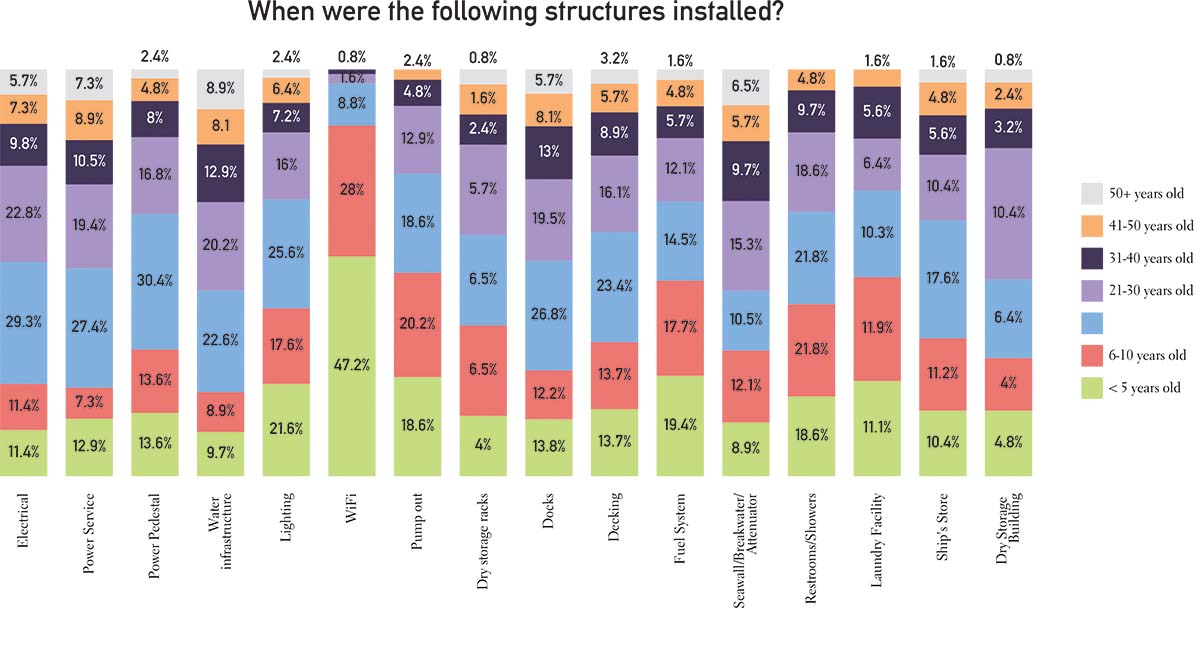

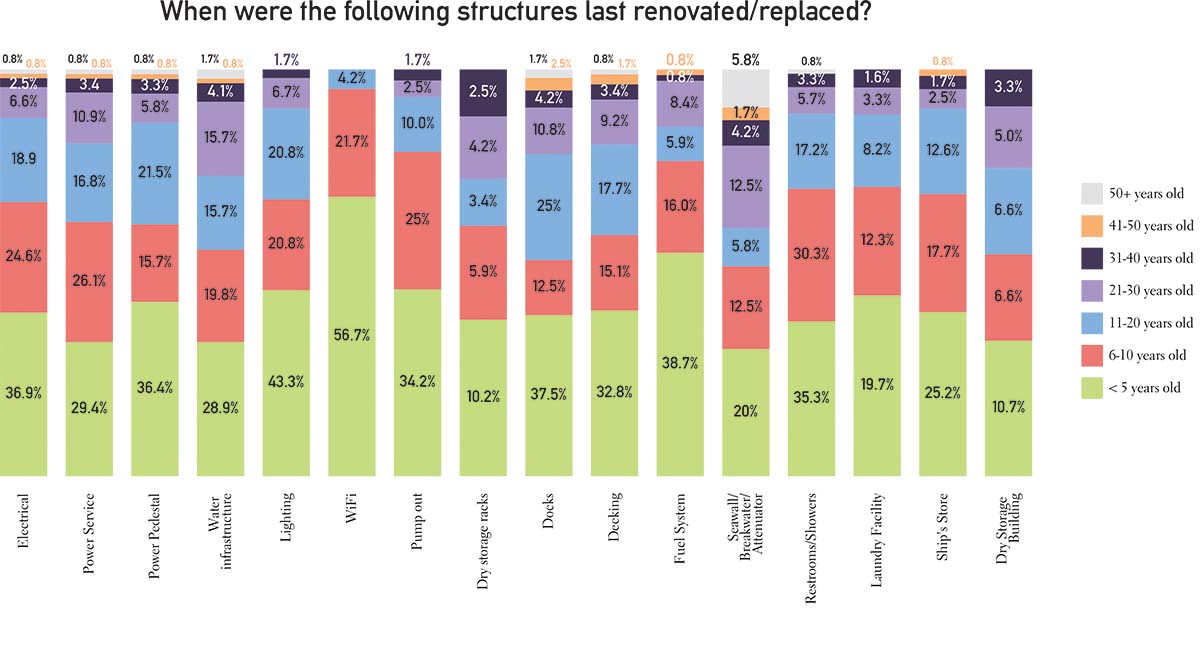

Items most likely to have been replaced or renovated in the last five years were lighting (43.33%) and Wi-Fi (56.67%). Overall, the question as to when different aspects of marina infrastructure were last renovated reveals an industry that stays up to date on deferred maintenance, as few respondents had items that had not been addressed in more than 20 years.

The response to when infrastructure was installed also reveals that a 20- to 30-year lifespan is generally what can be expected for docks, decks, electrical and restrooms.

| Categories | |

| Tags |